Manage Complexity![]()

In the insurance business, the claim is the moment of truth — how that claim is handled has a big financial impact on P&C insurers. In order to build a market-leading customer-centric business, insurers must accelerate digital transformation by leveraging new digital technologies that tackle dual priorities: Customer experience (CX) and Efficiency.

- Streamline Claims First Notice of Loss (FNOL)

- Improve claimant experience by speeding up settlement

- Increase efficiency through frictionless processing & automation

- Orchestrate recovery activities across the claim ecosystem

- Provide Self-service for effective engagement with claimants and partners

- Intelligent adjuster workplace & Business Designer for Agility

- Deliver Transparency

Papyrus manages all aspects of the claim process, enabling insurers to provide effortless claims experience across people, systems and channels end-to-end - from the first notice of loss to claims payment and closure.

Transparency and control of the total claims process

Leading digital capabilities have been put to work together to orchestrate and streamline operations across the claims ecosystem, boosting efficiency and helping claimants get quickly back to normal. The digital platform improves the customer experience via state-of-the-art mobile and self-service digital technologies enabling what is to become table stakes in the industry.

Empowering the business for improved claimant experience

Claimants can report a claim via digital devices and capabilities like a self-service portal, contact center, email, mobile or social channel.

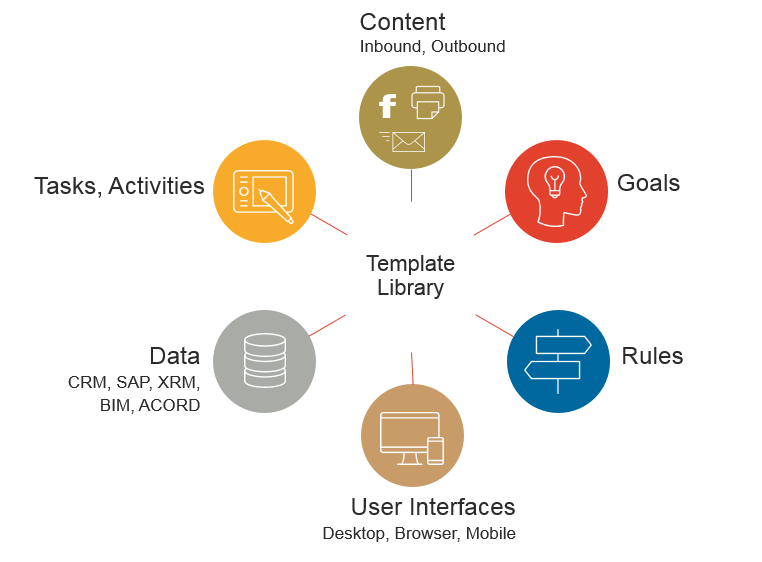

Business professionals use the Business Designer of the Papyrus Platform to define, create and maintain interactive forms, live chat, Wizards and other means to help claimants quickly navigate and upload data, photos, videos and documents.

Wizard processes defined with the Business Designer guide the claimant or the FNOL taker through the personalized Q&A interview process - each reply to a question leads to the corresponding follow-up question or action, following the most efficient path to gather required data specific to the claimant's case.

Papyrus Platform powerful tools, such as a Business Designer, make it easy for claims business technology teams to define and change communication and workflow automation. When working with high uncertainty, they can implement changes 'on-the-fly' and use them right away to adapt to new situations. All decision process steps and workflow modifications are saved and reviewed to be subsequently used in similar business situations.

Robotic and adaptive in one

Depending on the severity of the claim case, requests are handled in an automated way or may require human judgment and tap into the knowledge and expertise of your employees who have the right skills, availability and authority to handle specific types of requests. AI - User Trained built-in business intelligence learns from what users were doing to achieve their goals.

The learned action patterns allow proposing next best actions to other users helping them with their decisions in their specific situations. This way the need for hardcoded BPMN processes is reduced and flexibility gained. Automated intelligent capture uses machine learning classification and extraction to quickly interpret incoming requests via email, Web, Social, Mobile, Fax and mail.

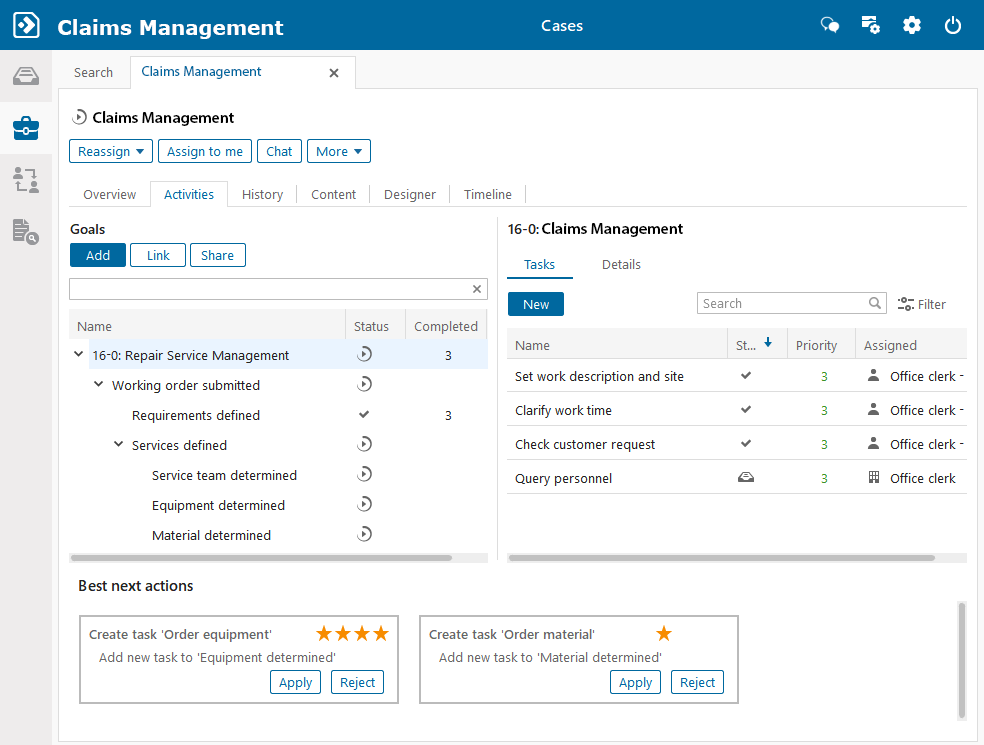

Boost adjuster productivity with an intelligent workbench

For increasingly specialized claims professionals to optimize performance, they need a centralized claims cockpit that provides them with what they need to know about the claimant in the context of the customer relationship and the current claim.

The easy-to-use Papyrus WebClient workplace hooks into internal and external data and provides rich Content services helping manage claims more efficiently. Insurer teams can view tasks, collaborate and act upon the current status of a claim with a 360-degree view of the claimant and the claim case and NO SWITCHING between systems. With direct access to data from policy, agent and document systems, examiners can address the individual needs of each claimant while maintaining a comprehensive view of the claims process across multiple policies and claimants.

They have a view of the complete incoming and outgoing communication, and can easily communicate back- and forth with claimants and partners with ready-touse templates and communication capabilities (phone, e-mail, SMS, etc.), which are made available directly through the workbench.

Gone are the days when multiyear, multimillion modernization projects were acceptable.

Insurance technology business organizations can't afford the time and expense it takes to customize a claim platform. They want to start with the basic model and have their professional teams extend, enhance, and customize the claim chassis using prebuilt connectors, such as APIs and microservices.