Optimizing Payment Processing with High-Quality Capture

Automated document recording ensures end-to-end compliance with powerful data handling

The Business

UniCredit Bulbank, a subsidiary of UniCredit Group, is Bulgaria's largest bank with assets exceeding BGN 11 billion in 2010. With approximately 4,000 employees and 230 branches throughout the country, the bank is servicing more than a million individual clients and households, high-profile private customers, small and mid-sized businesses, larger domestic and multinational corporations, municipalities and budget enterprises.

The Challenge

When Eastern European countries joined the EU and major international banks entered these emerging markets, the requirements for paper-based and electronic payments became more demanding. New priorities for these busy financial institutions included improvements in speed, accuracy and efficiency, as well as process enhancements for exceptions, visibility and security.

To ensure compliance with evolving regulations and policies, UniCredit Bulbank sought an end-to-end solution to completely automate its processes for recording tens of thousands of scanned payment documents daily - from more than 100 branches across the region.

The Solution

Among three payment transactions processing solutions, the scalable, flexible and powerful Papyrus Capture solution was selected to automate distributed document recording and validation across desktop and Web applications.

Key capture functions based on business rules and policies would ensure seamless and integrated operations for payment processing at UniCredit Bulbank:

- Secure transfer to the central processing office

- Recognition for handwritten and numbered areas

- Classification for 5 basic payment order types and 40+ sub-forms

The Future

Having used Papyrus Capture for more than a decade at UniCredit Bank Austria in Vienna, today UniCredit Bulbank automatically processes more than 50,000 payments daily with improved performance, integrated compliance and future-proof technology that is scalable for growing volumes, data sources and activity:

- Consolidated status overview of all processes

- Optimized balance of resources

- Integrated security

Distributed Capture and Advanced Processing

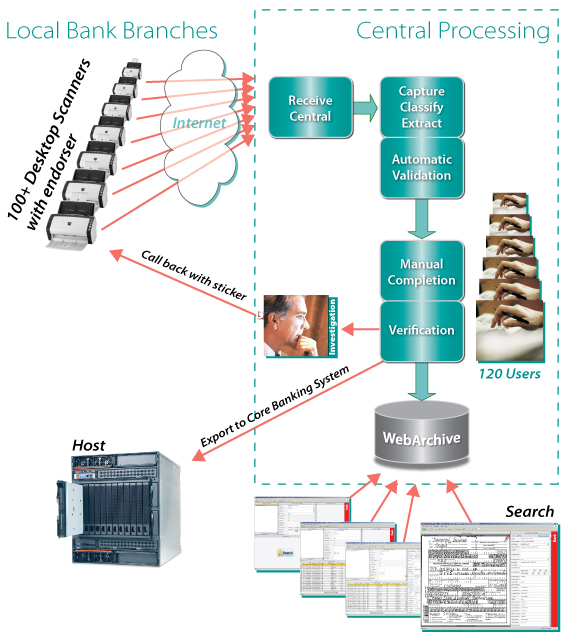

Beginning with receipt via more than 100 Fujitsu desktop scanners and ending with archiving in the Papyrus WebArchive, Papyrus Capture helps automate key capture functions based on the bank's business rules and policies:

- Inbound document transfer to central processing

- Text recognition for document classification and data extraction/recording

- Data validation based on document handling processes and quality procedures

- Export of payments & data to banking and archive

- Short-term online archive and long-term offline storage

Ensuring Quality and Accuracy

Before posting to the bank's accounting system, Papyrus enables the required strict validations, such as verifying the IBAN against customer account databases, as well as a two-tier manual process of data recording and checking to ensure absolutely correct records. For rejected items missing account information or other critical data, Papyrus can hold these until they are corrected or otherwise manually processed.

With emphasis on ergonomic and high-performance data recording, Papyrus EYE technology enables more than 120 internal users to electronically record ambiguities in a document by adding virtual stickers at the exact position, with a written clarification from the investigating user or referring branch.

Since introducing this innovative capture application with Papyrus, UniCredit Bulbank effectively maintains international and corporate standards of efficiency, accuracy, transparency and security:

- Resource balancing via distributed scanning and centralized data recording and processing

- Secure integration with encryption, role-based access rights and archiving

- Searchable stored documents via indexed archiving

- Complete failover coverage and document security