Winning the race against time

Renowned Tax Advisory Firm Accelerates Time-to-Market On Top Of The Papyrus Platform

Business Results

- Fast time to market

- Fully automated self-service for the Web and Mobile

- High levels of efficiency, while minimizing resource demand and property tax and compliance risks.

- All documents and processes can be easily adapted to new legal requirements in a very short time

- Nothing can bypass the service, everything has been covered in one value stream

Functional Requirements

- Adherence to basic tax compliance requirements

- Systematic acquisition of all necessary real estate and property tax data

- Calculation of the expected property tax charges

- Automatic generation of tax calculations

- Digital auditing of the real estate tax value assessments

- Transparent monitoring of the entire process

Papyrus Products at BDO

- Papyrus Web Repository

- Papyrus Business Designer (Interactive forms, documents, processes)

- Papyrus HTML-Client

- Papyrus REST-Adapter to ELSTER, BORIS-D

- Papyrus interface to external systems (Grizzly calculation engine)

- Papyrus DocEXEC high performance formatting

Snapshot

- Organization: BDO AG / BDO DIGITAL

- Business Challenge: Re-evaluation of the Property Tax

- Goals: Gathering Property Data, Interfaces to various Online Systems and calculating engines, Processing Data, Content & Documents, Auditing

- Integration: Data from various databases or files, direct output and sending over REST Interfaces to the tax and revenue office

- Solution: Adaptive Case Management (ACM), Business Designer, HTML & Mobile Solutions, Automated Document Factory

The Company

BDO provides a range of public accounting, tax consulting, legal, as well as the advisory services, and holds the position No 5 in the global market place. The company has presence in over 167 countries and employs 91000 staff members, generating 10 billion USD global revenue a year. BDO Digital Business Unit with the Enterprise Content Cloud Services division is part of the BDO AG in Germany.

The Challenge

How much more (or less) property tax will I have to pay? This question is currently on the minds of many property owners. Starting January 1st, 2022, taxes for properties in Germany are to be re-evaluated and re-calculated. Across 16 federal states owners of 35 million properties are called to submit re-evaluated real estate tax assessments to tax authorities not later than June 30.

Any legal entity that owns 100s and 1000s of properties - and there are many industries where this is the case - has the challenge of going through all documents relating to their properties, collecting and compiling the data and submitting re-calculated tax declaration in time. Data to be reported differs from state to state and is largely not available centrally or digitally.

The volume of work to accomplish is huge. However, it is not just a multitude of inputs that must be collected and compiled - the reform clearly requires tax intelligence to correctly assess the value and expects the final tax declaration to be filed in a standardized form as specified by the federal authorities. Using scarce internal human resources for this purpose or even building up staff did not appear to be expedient enough.

'Property Tax Reform-As-a-Service'

BDO AG was quick to recognize the high business potential of the new situation, but it had to react really quickly. The BDO vision: New automated solution that would provide high levels of efficiency, while minimizing resource demand and property tax and compliance risks.

The fact that the Enterprise Content Cloud Services division of BDO Digital provides cloud hosting of the Papyrus Communications & Process Platform made the decision for the new Property Tax Reform service fairly easy. With the BDO's strong expertise in taxes, the in-house technical competency, and the ready-to-use Papyrus Platform, the company was indeed very well positioned to build the new service cost-effectively in the shortest possible time.

BDO Grizzly - On top of the Papyrus Platform, running in the Cloud

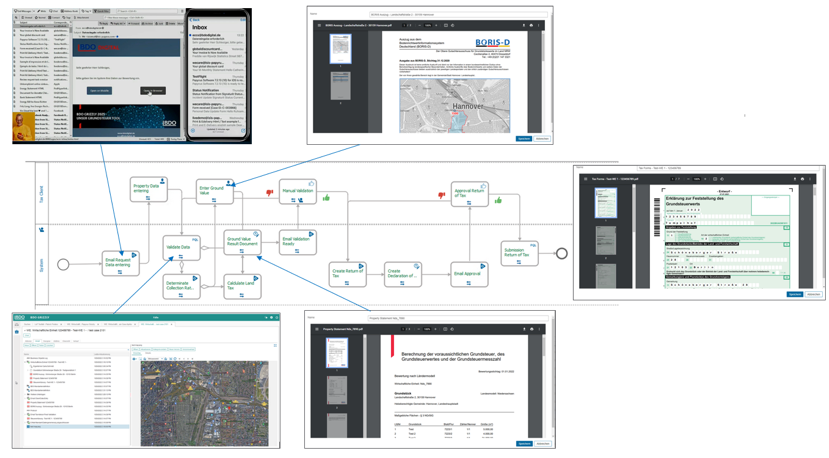

The new service leverages the integrated Adaptive Case Management capability of the Papyrus platform and runs smoothly as a value stream. Starting with the landlord who uploads the data on Web or Mobile to the intake of any type of content and subsequent legal processing, re-evaluation and re-calculated of taxes to audit and final submission of tax returns - all runs as a frictionless process, end-to-end.

By leveraging easy-to-use Business Designer tools for non-technical users instead of coding, the entire application - process, rules and communication - was created in half the time it took for the original analysis. Approx. 80% of everything that was needed to create the new service was in fact provided as a part of the Papyrus Business Designer and platform itself.

"We have realized this project in a matter of just a few months together with our colleagues from the tax advisory. With the new Cloud service, we can now support our clients to successfully master the challenge regardless of the number of properties to be valued. This is this beautiful example of what you can do with the Papyrus platform. I am sure there will be more solutions to follow"John-Erik Horn, Managing director of BDO Digital.

Efficiency paired with Flexibility and Adaptivity

The fully automated process handles large amounts of tax calculation requests, and integrates with various systems to import data and make it centrally available in the system. All processes, forms and documents are managed as templates and can be quickly adapted to new requirements if the specifications for the tax reform change. The continuity is provided across multiple devices and Web and Mobile user interfaces for both tax advisors and end users who can easily enter, upload and verify the data.

The global portal of BDO is the central login point that connects to the new service, which in turn works together with the BORIS - D German land value information system and calls up the BDO Grizzly solution for the re-calculation and re-valuation of taxes. The system uses the collected information to create the expected property tax document and notifies tax advisor via mobile phone or Web to perform the final review. In case there is still something missing or it needs to be verified, the tax advisor can request additional information, otherwise the document is provided to the landlord for the final review and consent. Once approved, final documents are automatically generated and transmitted via ELSTER Online Tax Office Portal to tax authorities.

The process provides full transparency with all data available for the review at any time. Authorized persons can look into the data, see which documents and content were entered, which documents were generated and see every step - when it was taken, by whom it was done, and how long did it take.